Private equity interest in longevity and wellness accelerated in 2024–2025, driven by demographic shifts, widening healthspan gaps, and increasing consumer demand for preventive care. Several investment research reports highlight a widening gap between lifespan and healthspan, now estimated at roughly a decade in developed markets (Oppenheimer & Co., 2025). This interest is further driven by breakthroughs in biotechnology and innovations in technology-driven care. Younger generations, especially Gen Z and millennials, are reshaping wellness by prioritizing daily, personalized health practices and embracing tech-enabled solutions like AI-powered apps, biomonitoring devices, and functional nutrition. Research from McKinsey & Company’s Future of Wellness 2025 report shows that approximately 84 % of U.S. consumers say wellness is a top or important priority when making purchasing decisions, highlighting the strong influence of wellness considerations on consumer behavior. Their willingness to invest in wellness and longevity products and services serves as a major tailwind, supporting the increased market growth expectations.

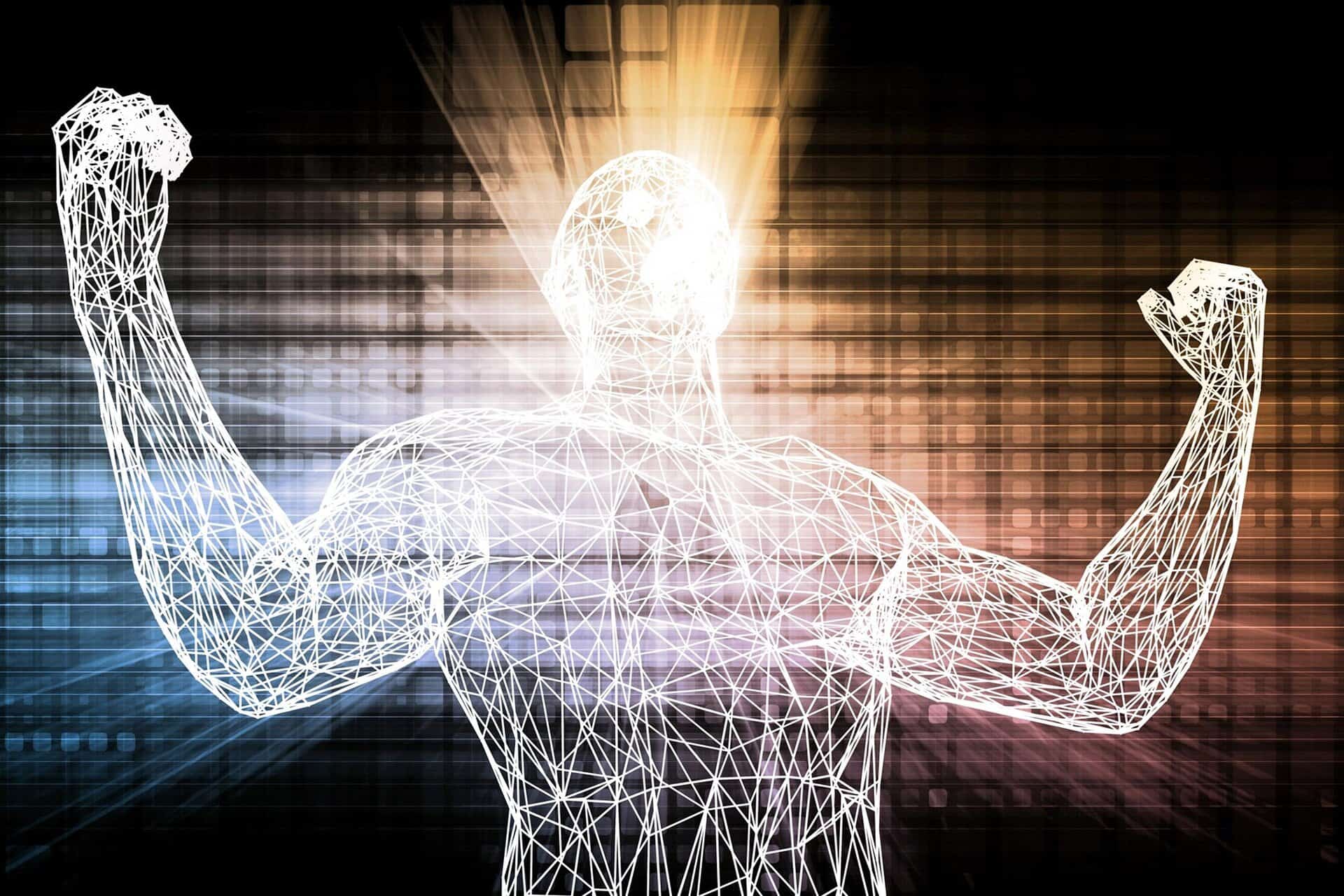

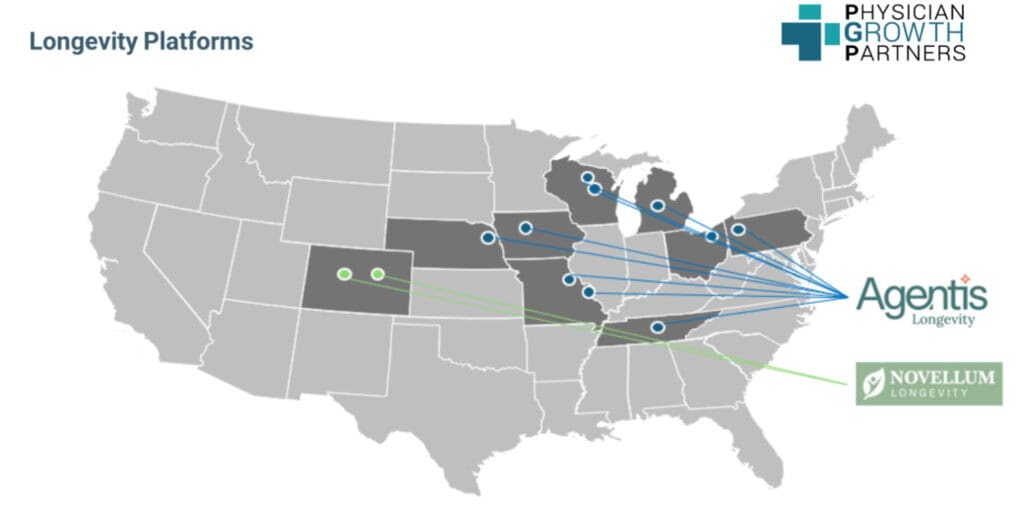

Despite increased caution in healthcare private equity investment across physician services, the longevity space continues to draw interest due to its high‑growth potential, recurring revenue opportunities, and alignment with preventive health trends and wellness goals.

The longevity market includes anti‑aging therapies, regenerative medicine, personalized health platforms, and consumer wellness products. Market estimates vary, with some research projecting growth from approximately $65B in 2023 to over $300B by 2030 (Apex Leaders, 2025).

Leading companies are prioritizing epigenetic reprogramming, senolytic therapies, and AI‑based drug discovery. At the same time, consumer offerings such as NAD+ boosters, cryotherapy, and hyperbaric oxygen therapy are seeing steady growth. Notably, Human Longevity, Inc. raised $39.8M in late 2024, joined by new funding rounds for NewLimit and Cyclarity Therapeutics to advance AI-breakthroughs (Live Forever Club). All together, these deals highlight a specialty moving into its next growth phase, with investors focused on scalable technologies connecting biotech and consumer wellness. Ultimately, private equity capital deployment in longevity and wellness is in its nascency, but strong funding, growing overall consumer interest, and advancing research suggest there is major long-term value creation potential for investors.

As growth capital continues flowing into the sector, a new generation of venture-backed startups is emerging to build the infrastructure that enables clinicians to participate in the longevity and wellness movement without assuming excessive operational complexity. These companies are focused on technology-enabled services that bridge traditional primary care and consumer wellness – providing clinical workflows, AI-driven personalization tools, remote monitoring capabilities, and turnkey operational support.

One example of this is Peak Health. “Peak Health recently emerged from stealth mode to meet growing demand from primary care physicians, medspa owners, and other clinicians who want to build longevity and wellness offerings within their practices,” said Jaclyn Kawwas, Head of Commercial at Peak Health. “The next wave of healthcare innovation will be tech-enabled services that empower physicians to deliver proactive, personalized care – not just reactive treatment. We’re building the infrastructure to make that transition seamless.”

Recent Investments and Developments

As longevity and wellness centers grow and add more services, private equity partners can provide important support in both operations and long‑term strategy. Private equity helps practices save money by providing expertise on operations and development so the physicians can focus on their patients and technology. Using these resources, providers could introduce personalized care plans, upgraded testing, and user-friendly health tracking technologies.

Private equity represents a strategic advantage for longevity and wellness businesses by offering both the capital and specialized expertise essential for growth. Private equity enhances care delivery, assists operations, and facilitates service expansion, making treatments more accessible and affordable. Given the extended timelines required for scientific breakthroughs, private equity’s long-term commitment is especially well suited to helping these businesses accelerate growth, improve patient outcomes, and maintain a competitive edge.

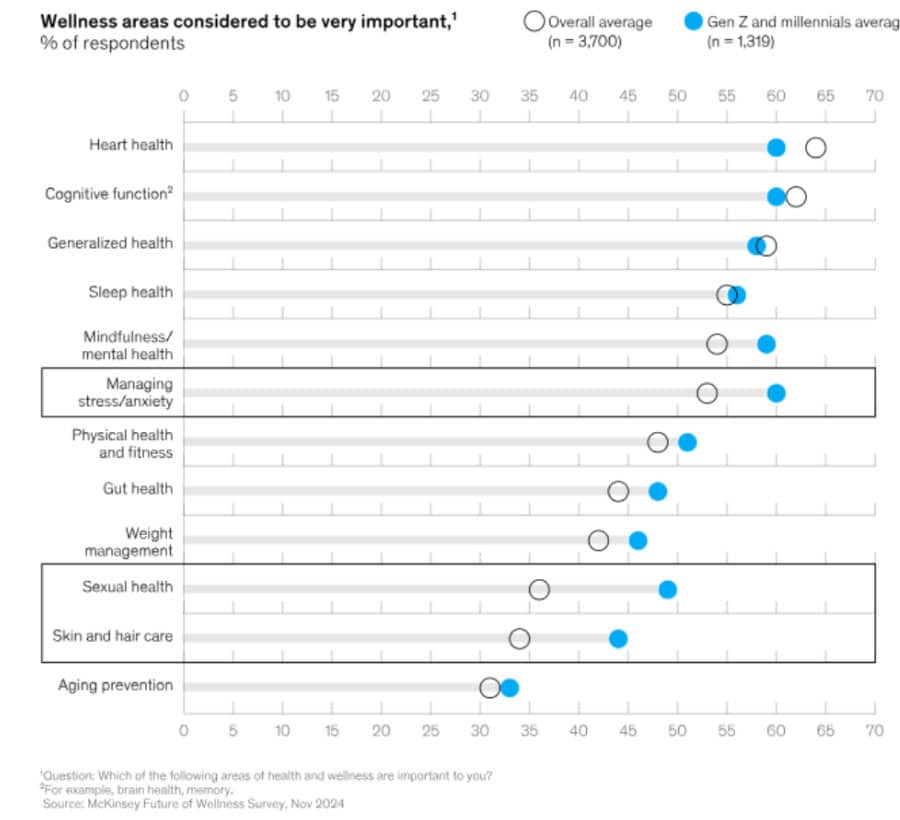

Below is a chart highlighting how health concerns among Gen Z and millennials align with the average priorities across all age groups.

Chart from McKinsey & Company

Younger generations’ wellness priorities closely align with broader consumer concerns such as heart health, cognitive function, and mental well-being, areas that consistently rank high in importance for aging groups. This overlap creates a strong foundation for the longevity market, as it reflects a growing and consistent demand from both younger, health-conscious consumers and older adults.

The current market gives early-stage longevity entrepreneurs an ideal moment to grow, but also a need to act fast, as rising investor interest and competitive platforms will shift valuations and market dynamics.

Private equity’s long holding periods align well with longevity investors who can lock capital away without needing immediate liquidity, allowing general partners to exit investments under optimal market conditions rather than reacting to short-term volatility (Astrea 9 Investment Highlights). Our team guides leadership teams through key negotiations on clinical priorities, and post-close expectations to secure terms that matter. The right partnership not only accelerates growth but also preserves what makes the business unique while positioning it to capture the full upside of expected growth rates.

Gen Z & Millennial Generations

Baby Boomers & Gen X

When evaluating a potential partner, it is extremely important to find the right fit to ensure a strong go-forward partnership. PGP advises that four critical factors need to be considered when evaluating whether a partner is right for your business:

Interested in learning more? Fill out the form below to schedule a confidential discussion around current market dynamics, how your practice would be positioned, and learn whether private equity is the right fit for your goals.

References:

AlphaSense. (2025). FSE5227 AlphaSense.

Azalea Asset Management. (2025, September 17). Astrea 9. https://www.azalea.com.sg/products/astrea-9

“Live Forever Club- Longevity.” Live Forever Club, liveforever.club/page/home. Accessed 7 Aug. 2025.

L’Oréal Group. (2025, January 7). Beauty at the heart of longevity: L’Oréal Groupe. L’Oréal. https://www.loreal.com/en/press-release/group/beauty-at-the-heart-of-longevity-loreal-groupe

Oppenheimer & Co. Inc. (2025, July 21). The future of health: Investing in longer, healthier lives [Audio podcast episode]. Oppenheimer. https://www.oppenheimer.com/news-media/2025/podcast/the-future-of-health-investing-in-longer-healthier-lives

Pione, Anna, et al. “The $2 Trillion Global Wellness Market Gets a Millennial and Gen Z Glow-Up.” McKinsey & Company, McKinsey & Company, 29 May 2025, www.mckinsey.com/industries/consumer-packaged-goods/our-insights/future-of-wellness-trends.

“The Longevity Market Holds Strong Promises for Investors.” Apex Leaders, 12 June 2025,apexleaders.com/trend-reports/the-fast-growing-longevity-industry-holds-strong-promise-for-investors”