Ambulatory Surgery Centers remain one of the strongest corners of healthcare services M&A. Investment has compounded over the last decade as payers, providers, and patients push procedures to lower-cost outpatient settings. With CMS continuing to expand ASC-eligible procedures and implementing steady reimbursement rate increases, we expect continued consolidation and platform expansion in the surgery center market. According to The Business Research Company, the global ASC market is projected to grow from $83.34 billion in 2024 to $108.76 billion by 2029, reflecting a compound annual growth rate (CAGR) of 5.2%. Recent deal flow has been driven by surgery center consolidators, hospital joint ventures, private equity backed MSO buyers, and several high-profile strategic partnerships.

Despite broader healthcare M&A volatility, ASC consolidation has stayed resilient. From a consolidation standpoint, buyer interest depends on the buyer type. Some will target only the surgery center, while others will seek to acquire both the surgery center and the associated practices that operate in the center.

For instance, Private equity MSO buyers pursuing a single- or multi-specialty platform typically prefer to acquire both the practice and affiliated surgery center, as they view the practice as the primary engine and the surgery center as a complementary ancillary that captures the facility fee revenue. Private equity MSO buyers will generally want to confirm that the practice’s shareholders or employed physicians hold majority ownership in the surgery center.

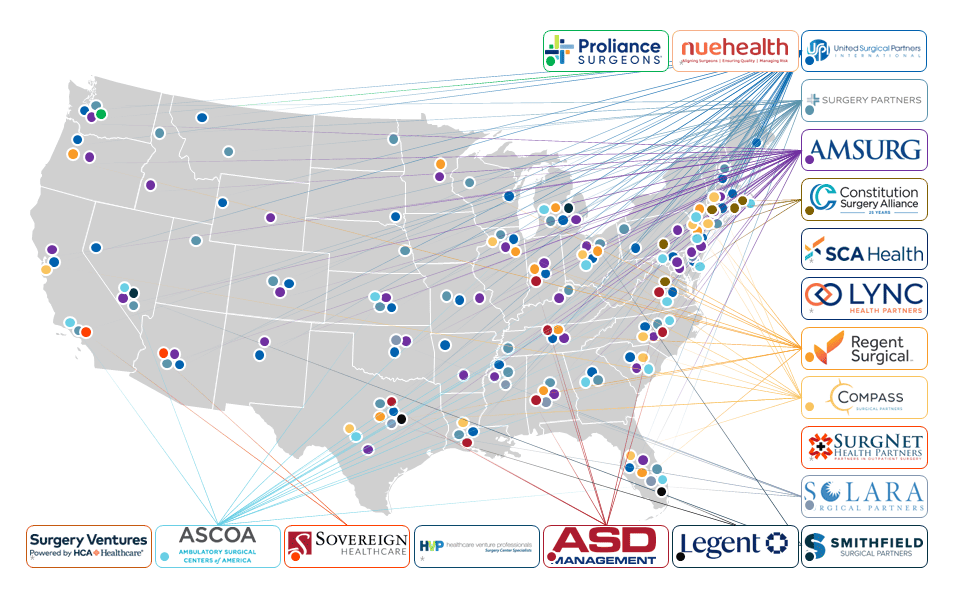

On the other hand, surgery center consolidators (Constitution Surgery Alliance, USPI, SCA Health, Surgery Partners, HCA, Regent, etc.) continue to emphasize their efforts on acquiring only the surgery center to capture the facility fee. They aim to leverage economies of scale and operational expertise to enhance reimbursement, build out infrastructure, improve operational performance, and ultimately achieve stronger results than would be attainable independently in the market.

Health systems are also increasingly active buyers and partners, pursuing ASCs as part of an outpatient strategy to retain procedural volume, enhance physician relationships, and compete with operators.

The range of available strategic alternatives has made it more compelling than ever for independent single- or multi-specialty surgery center operators to assess their options.

Heading into 2026, we expect:

For ASC owners, today’s mature market offers compelling opportunities alongside new complexities. With a wide range of strategic operators, health systems, and private equity-backed buyers active in the space, there is significant variability in deal structures, valuations, and partnership models.

Many centers that historically operated independently are now reevaluating partnership opportunities, as valuations remain attractive and the practice of medicine becomes increasingly complex. The benefits of a partner such as access to growth capital, enhanced operational resources, and strategic expertise are becoming increasingly clear.

However, capturing full value requires more than simply responding to inbound interest. Running a formal, competitive process ensures owners can:

Ensure the buyer has a successful track record

| Date | Target | PE Sponsor | Platform | State |

| Dec 2025 | Advanced Center for Surgery | Ascension | AMSURG | PA |

| Oct 2025 | Valley ASC | Ares Management | Duly Health and Care; Surgery Partners | IL |

| Oct 2025 | Surgery Center of Conway | Ascension | AMSURG | SC |

| Oct 2025 | Legent Health | Hospital for Special Surgery; General Atlantic | New | TX, FL |

| Aug 2025 | Irvine Medical Management (Anaheim Surgery Center) | Sun Capital Partners | CA |

The ASC market remains one of the most active and competitive segments within healthcare services M&A. For owners evaluating their future, whether they are considering a sale or planning for a transaction several years from now, preparation and understanding the buyer landscape are essential.

Physician Growth Partners (PGP) has advised on numerous transactions involving surgery centers and specialty practices with ASC operations. Our tailored processes help owners navigate the competitive environment, select the right partner, and maximize both immediate and long-term value.

Interested in learning more? Fill out the form below to schedule a confidential discussion around current market dynamics, how your center would be positioned, and whether a strategic partnership is worth exploring.

The Business Research Company, “Ambulatory Surgery Center Market Report 2025, Size and Analysis.” The Business Research Company ASC Market Update, Jan. 2025,