Private equity’s relatively recent entrance into the pediatrics space has continued to accelerate year over year, following Webster Equity Partners’ creation of US Pediatric Partners (USPP) in 2023. USPP was established in partnership with Pediatric Affiliates, which was advised by Physician Growth Partners (PGP) in the transaction. At the time, USPP represented one of only two traditional private equity–backed platforms in the pediatric landscape.

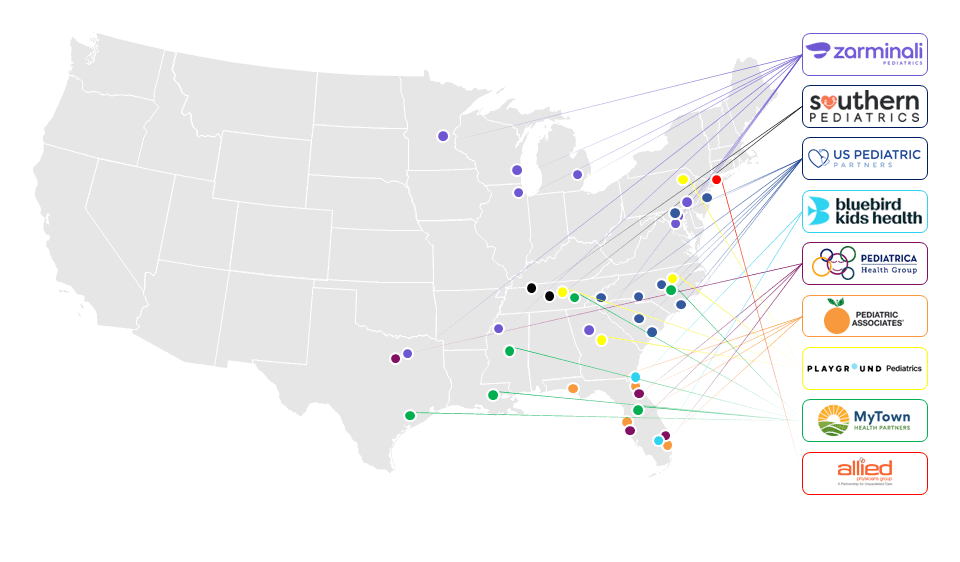

Fast forward to today, and there are now more than eight traditional consolidators actively operating in the space, with a growing number of private equity firms continuing to search for the right foundational asset around which to build a pediatric platform.

As of January 2026, two noteworthy announcements have created additional momentum in the space: first, Zarminali Pediatrics announced it landed $110M in a Series A venture funding round to continue its aggressive geographic expansion; second, US Pediatric Partners announced its strategic affiliation with Aspen Pediatrics, a portfolio company of The Nashton Company, marking USPP’s formal entry into the Maryland market.

Deal activity and overall positive sentiment was further validated just months ago when the Centers for Medicare & Medicaid Services (CMS) released its Calendar Year (CY) 2026 Medicare Physician Fee Schedule Proposed Rule in July 2025. The proposal continues CMS’s shift toward time-based, patient-facing care, consistent with broader value-based care (VBC) objectives. Notably, the rule introduces the first-ever efficiency adjustment, which reduces relative value units (RVUs) for non–time-based services while modestly increasing RVUs for time-based services, such as evaluation and management (E/M) visits. Primary care specialties – including pediatrics, which rely heavily on time-based coding – stand to benefit, reinforcing the structural tailwinds already supporting the specialty.

Additionally, the CY 2026 Qualifying Alternative Payment Model (APM) conversion factor is projected to increase by 3.83%, further signaling CMS’s continued commitment to advancing value-based care models.

For pediatric groups considering their next phase of growth – whether driven by scale, long-term sustainability, succession planning, or a combination thereof – private equity remains a relatively young yet compelling option to explore. As with any physician specialty, success hinges on several critical factors, including the preservation of clinical autonomy, alignment with an experienced healthcare-focused investor, effective payor negotiation, and the ability to integrate practices thoughtfully while providing value-added resources and strong local governance.

When these elements are aligned, private equity partnerships can often present a more attractive path forward than affiliating with a health system or remaining independent without the capital and infrastructure required to compete. In an environment that increasingly rewards scale, quality, and the ability to clearly articulate both, pediatrics is particularly well positioned to benefit from the right strategic partner.

| Date | Target | PE Sponsor | Platform | State |

| Nov 2025 | All Better Pediatrics | General Catalyst | Zarminali Pediatrics | TN |

| Nov 2025 | Tuka Pediatrics | M33 Growth | Pediatrica Health Group | FL |

| Oct 2025 | PAK Pediatrics* | Norwest Venture Partners / Healthcare Foundry | Playground Pediatrics | PA |

| Oct 2025 | Scarano and Taylor Pediatrics | M33 Growth | Pediatrica Health Group | FL |

| Oct 2025 | Boca Pediatric Group | Pine Tree Equity Partners | Nuvia Medical Group | FL |

| Oct 2025 | Tennessee Pediatrics | Southern Pediatrics | TN | |

| Sep 2025 | Sartell Pediatrics | General Catalyst | Zarminali Pediatrics | MN |

| Sep 2025 | My Child’s Therapy | Waud Capital Partners | Ivy Rehab for Kids | PA |

| Sep 2025 | Capote Pediatrics | M33 Growth | Pediatrica Health Group | FL |

*PGP served as Exclusive Advisor to PAK Pediatrics

Physician Growth Partners (PGP) Physician Growth Partners (PGP) is an advisory firm working exclusively with independent physician groups in transactions with private equity.

PGP has completed 12 transactions in the last 12 months. Our firm is differentiated by: