After reaching record levels in 2022, private equity (PE) investment in eye care slowed in 2023, driven by rising interest rates, broader macroeconomic pressures, and the natural maturation of platforms that shifted focus toward integration and organic growth. However, deal flow is beginning to rebound significantly as investors renewed their appetite for acquisitions.

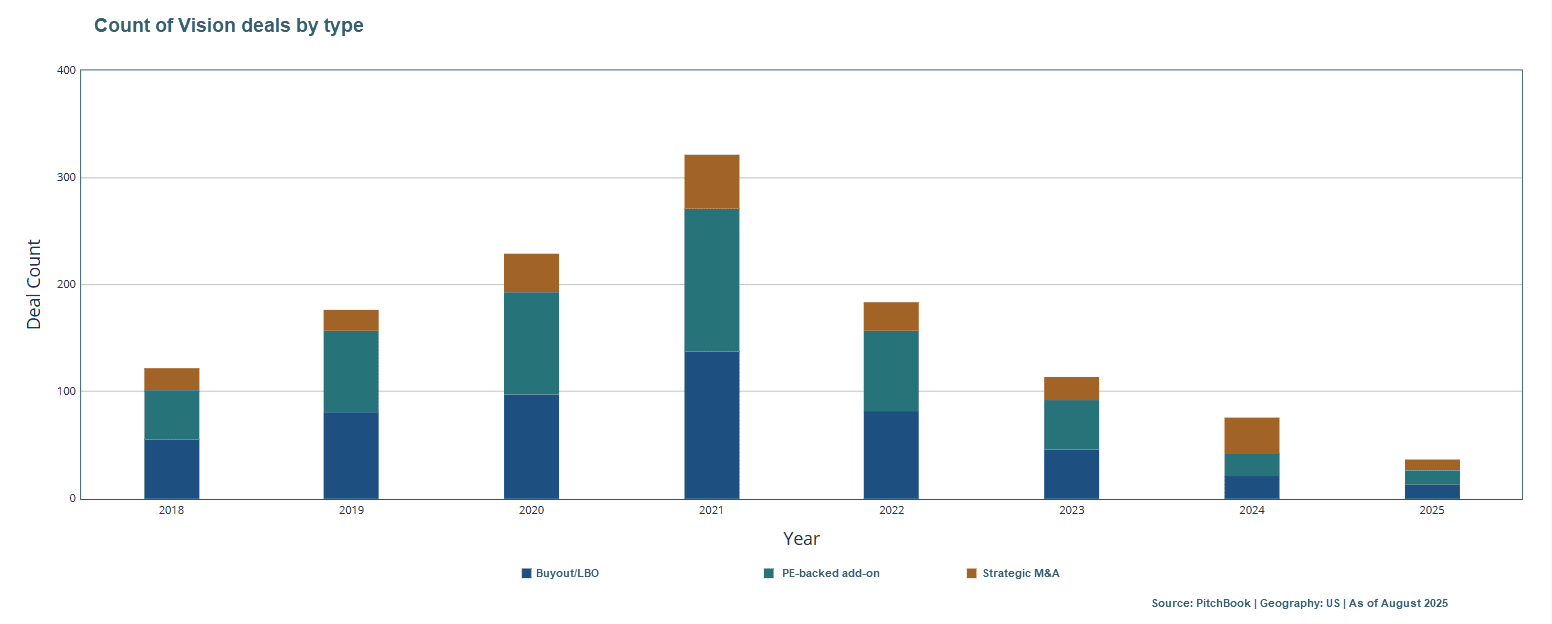

The chart below, sourced from PitchBook, illustrates this transition: from the 2022 peak to a slowdown in 2023. While the pace of deals has started to shift, eye care has remained one of the most resilient and competitive specialties, drawing strong interest from both traditional private equity platforms and corporate conglomerates alike.

Activity in 2024 – 2025 has included:

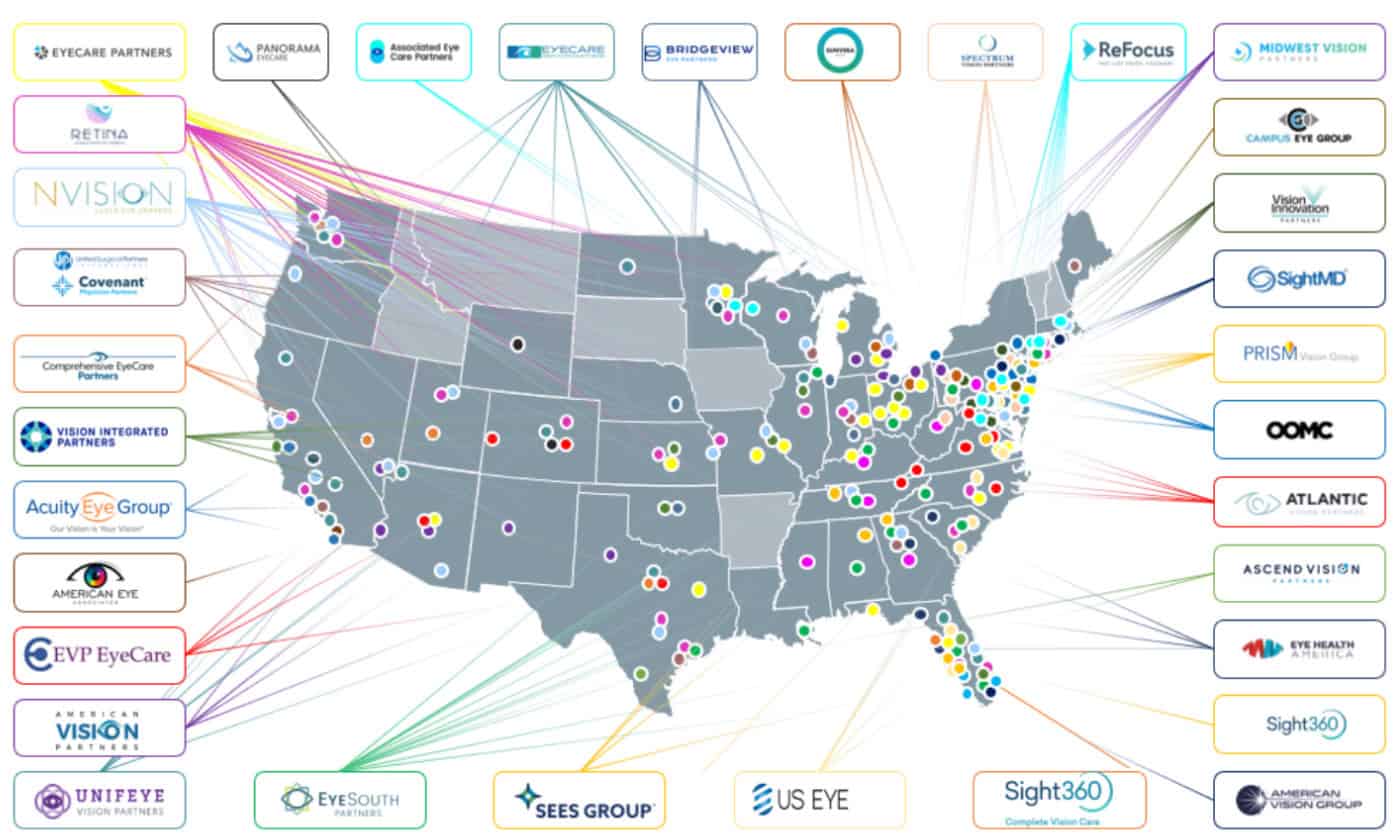

– Regional Density Building: Eye Health America’s acquisition of Quigley Eye as well as Eye South’s acquisition of Sunvera, both “second” bite transactions, reinforcing the drive toward market consolidation.

– National Expansion: Unifeye Vision Partners acquiring Brooks Eye Associates in Texas, extending their reach into a state where they previously had no direct or adjacent presence.

– Corporate Conglomerate Moves: Cencora acquiring Retina Consultants of America in November 2024 and McKesson acquiring PRISM Vision in April 2025, signaling increasing interest from corporate strategics investing in the provider services sector alongside traditional PE.

Eye care is at an inflection point as many early private equity platforms prepare for second or third sales, attracting interest from private equity, larger consolidators, and corporate buyers. Competition and valuations for quality assets is expected to continue into 2026, though buyers are becoming more selective. Certain private equity–backed groups are addressing operational challenges before pursuing new transactions. At the same time, state-level regulations continue to create hurdles for transactions, which are only expected to increase. These challenges are only expected to intensify over the years to come.

As physician-owners consider their strategic futures and the potential role of private equity, today’s complex dynamics make experienced guidance critical in deciding how and when to approach the market.

| Date | Target | PE Sponsor | Platform | State | |

| November 2025 | Spokane Eye | McKesson (NYSE: MCK) | Prism Vision Group | WA | |

| October 2025 | Eyes & Optics | Regal Healthcare Capital | InFocus Eyecare | FL | |

| September 2025 | The Retina Institute | Webster Equity Partners | Retina Consultants of America | MO, IL | |

| August 2025 | Sunvera Group | Shore Capital Partners | Eye South Partners | MI, OH, PA | |

| July 2025 | St. Lucie Eye | Olympus Partners | EyeSouth Partners | FL | |

| July 2025 | New View Eye Center | Zenyth Partners | ReFocus Eye Health | VA | |

| June 2025 | Eye Care of Delaware | Gryphon Investors | Vision Innovation Partners | DE | |

| June 2025 | Atlantic Retina Center | Zenyth Partners | ReFocus Eye Health | MD / DE | |

| June 2025 | Schneider Eye & Wellness Center | LLR Partners | Eye Health America | FL | |

| April 2025 | Prism Vision Group | McKesson (NYSE: MCK) | N/A | VA | |

| April 2025 | Farr Eyecare | VSP Vision | VSP Ventures | AZ | |

| March 2025 | Retina Institute of Illinois | Olympus Partners | EyeSouth Partners | IL | |

| March 2025 | Eye Center of Central Georgia | LLR Partners | Eye Health America | GA | |

| February 2025 | Quigley Eye Specialists | LLR Partners | VSP Ventures | FL | |

| January 2025 | Sambursky Eye & Esthetics | Chicago Pacific Founders | SightGrowthPartners / SightMD | NY | |

| December 2024 | Retina Associates of Middle Georgia | Olympus Corp. | EyeSouth Partners / Georgia Retina | GA | |

| October 2024* | Kentucky Eye Institute | Olympus Partners | EyeSouth Partners | KY |

*PGP Served as Exclusive Sell-Side Advisor to Practice Owners (Target)

Physician Growth Partners (PGP) is a transaction advisory firm working exclusively with independent healthcare groups in transactions with private equity.

Differentiated Healthcare Transaction Advisors: