Despite a more favorable interest rate environment and signs of stabilization in the broader economy, overall healthcare M&A activity in the first half of 2025 has remained mixed. However, private equity investment in ENT & Allergy continues to demonstrate resilience, underpinned by strong platform fundamentals and ongoing interest in ancillary-heavy physician specialties.

As one of the most fragmented subspecialties in medicine, ENT practices continue to stand out for their diverse ancillary offerings, including ambulatory surgery centers, allergy and asthma services, audiology, hearing aids, sleep centers, and pediatric ENT. Groups with robust ancillary integration and operational sophistication are still commanding premium valuations.

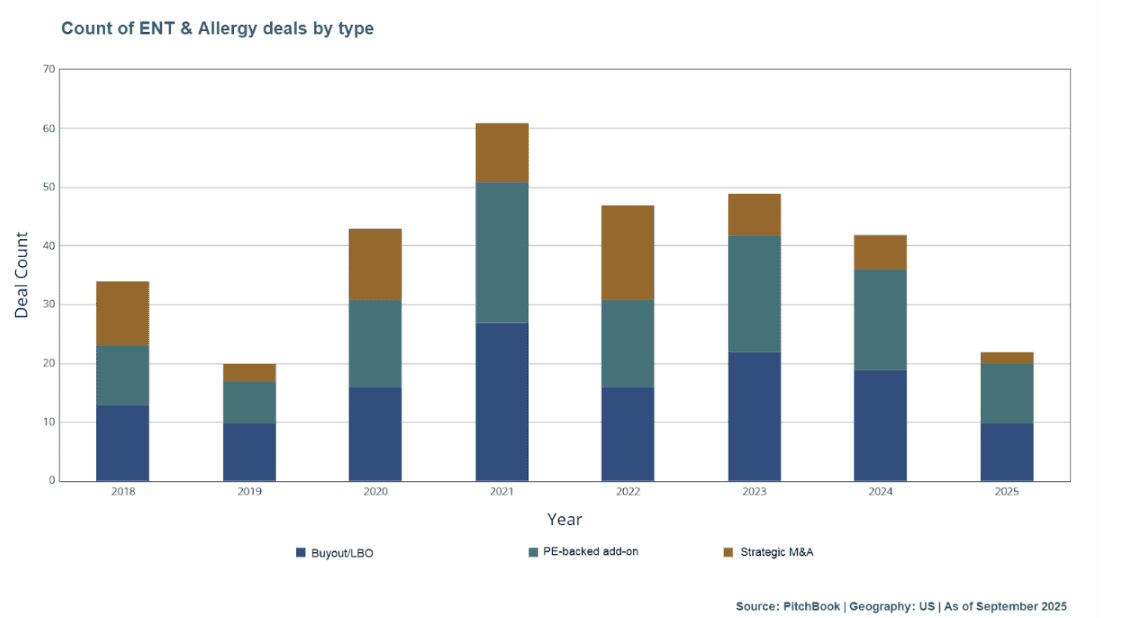

Platform activity has remained concentrated in the Midwest, Northeast, and Southeast, but 2024 -and 2025 have also seen increased interest in previously underpenetrated regions. Align ENT + Allergy, ENT Partners, and Elevate ENT Partners remain among the most acquisitive consolidators. Recent growth by these groups has focused on tuck-ins that complement existing regional density, with some platforms also signaling interest in de novo expansion in existing markets. As evidenced by the below chart from Pitchbook, deal activity is down since the peak in healthcare M&A in 2021, yet investors are still competing for higher quality practices.

As a result of investors seeking higher quality assets, valuations have maintained their attractiveness, especially for quality run groups whereby multiple offers drive up the enterprise value (EV) upon the practice sale.The Western US continues to offer the most white space for new platform formation, particularly in California and the Pacific Northwest, where limited platform presence creates an opportunity for practices to serve as beachheads. These market-entry transactions typically offer founding physicians regional leadership roles, a greater degree of autonomy, and significant equity upside.

Meanwhile, practices in more saturated geographies like the Midwest benefit from robust buyer competition and optionality in partner selection. These markets have seen rising valuations and more structured processes, with sellers receiving multiple competitive bids from both established platforms and newly capitalized entrants. Further, larger groups in geographic markets that already contain a level of PE-backed presence still maintain the opportunity to serve as regional leaders within the organization. Said differently, there is no geographic constraint for large platforms interested in a potential partnership, and smaller, sub-specialized groups remain highly sought after in the Midwest, Northeast and Southeast in particular, followed by the Southwest.

| Date | Target | PE Sponsor | Platform | State |

| July 2025* | Allergy & Asthma Associates of Commerce Township | Zenyth Partners | Align ENT + Allergy | MI |

June 2025 | Camellia ENT | Audax Private Equity | Elevate ENT Partners | LA |

| June 2025 | ENT Specialists | Candescent Partners | ENT Partners | IL |

| March 2025 | Princeton Allergy & Asthma Associates | Zenyth Partners | Align ENT + Allergy | NJ |

| January 2025 | Alan E. Oshinsky, MD, PA | Candescent Partners | ENT Partners | MD |

| January 2025 | The Hearing Wellness Center | Candescent Partners | ENT Partners | MD |

| December 2024 | Jacksonville ENT Surgery | Audax Private Equity | Elevate ENT Partners | FL |

| December 2024* | Allergy & Asthma Associates of Michigan | Trinity Hunt Partners | Parallel ENT & Allergy | MI |

| September 2024 | Mid-Michigan ENT | Zenyth Partners | Align ENT + Allergy | MI |

| September 2024 | Vernose & McGrath ENT Associates | Zenyth Partners | Align ENT + Allergy | PA |

| July 2023 | Coastal Allergy & Asthma | Shore Capital | SENTA Partners | GA |

| July 2024 | Melnick, Moffitt, & Mesaros ENT Associates | Zenyth Partners | Align ENT + Allergy | PA |

| May 2024 | Cornerstone Ear, Nose, & Throat | Shore Capital | SENTA Partners | NC |

| May 2024 | Ear, Nose, and Throat Specialists of Connecticut | Zenyth Partners | Align ENT + Allergy | CT |

March 2024 | Pinnacle ENT, Providence ENT, Berger Henry ENT, Greenwich ENT | Zenyth Partners | Align ENT + Allergy | CT, PA |

*PGP Advised on the Transaction (Target company is PGP client)

Physician Growth Partners (PGP) Physician Growth Partners (PGP) is an advisory firm working exclusively with independent physician groups in transactions with private equity.

PGP has completed 15+ transactions in the last 12 months. Our firm is differentiated by: