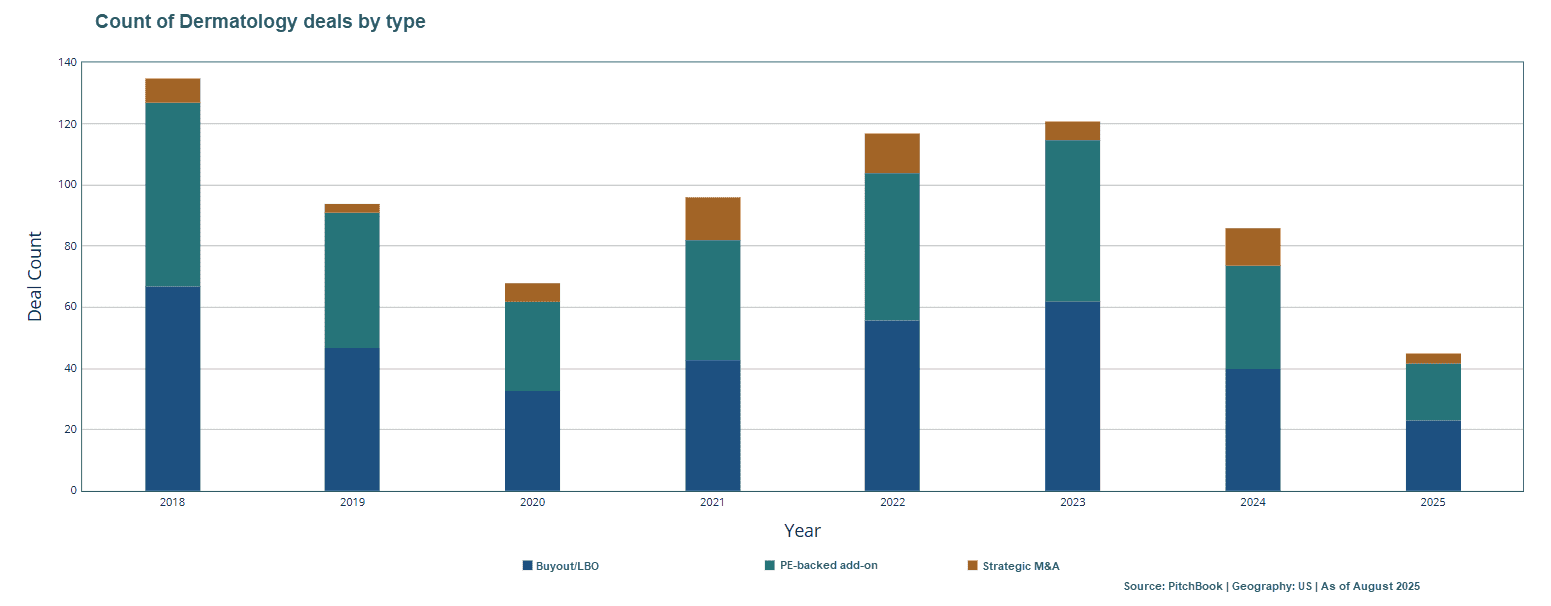

As we move through the midpoint of 2025, investor interest in dermatology remains extremely strong, consistent with the specialty’s history of robust M&A activity. Deal flow, however, has shifted meaningfully since the frothy, volume-driven environment of 2021–2022. With rising interest rates and a more selective investor mindset, M&A activity beginning in mid-2023 has been characterized less by sheer volume and more by higher-quality transactions. The chart below, sourced from PitchBook, highlights this transition and underscores how dermatology remains one of the most resilient and active physician specialties despite evolving market conditions.

Following this broader market shift, dermatology has continued to experience meaningful consolidation. The last major wave of activity came in 2022 with significant platform combinations, including QualDerm Partners merging with Pinnacle Dermatology and Platinum Dermatology combining with West Dermatology. Around this same period, several “second and third bite” transactions reshaped the landscape, such as CI Capital’s sale of Epiphany Dermatology to Leonard Green & Partners, DOCS Dermatology’s sale from Sheridan Capital Partners to SkyKnight Capital, and Forefront Dermatology’s third bite from OMERS to Partners Group.

More recently, consolidation has been led by Schweiger Dermatology, with its acquisition of United Skin Specialists in 2024 and its landmark purchase of California Skin Institute in 2025. These headline deals were complemented by substantial add-on activity from groups positioning themselves for a successful “next bite” in the near term.

Dermatology’s growth has been further fueled by the continued cosmetic interest, driving acquisitions of med spas and plastic surgery clinics as groups pursue a broader “skin health” strategy. This convergence of medical and cosmetic dermatology continues to attract strong investor attention, reinforcing the specialty’s position as one of the most active within physician services M&A. At the same time, buyers are narrowing their focus, yet when a high-quality asset comes to market, competition and valuations remain strong. Many private equity backed dermatology groups are also approaching their second or third recapitalizations, adding fresh capital to continue with deal activity. However, the regulatory environment at the state level continues to create hurdles for transactions. These challenges are only expected to intensify over the years to come.

Intial Platform investments only, does not reflect add-on locations

contact@physiciangrowthpartners.com

| Date | Target | Buyer | PE Backer | State |

| October 2024 | Exceptional Dermatology Care | PhyNet Dermatology | Century Equity Partners | CA |

| November 2024 | Dermatology and Surgery Associates | Schweiger Dermatology | LMK Partners | NY |

| November 2024 | George Dermatology | Epiphany Dermatology | Leonard Green Partners | MO |

| December 2024* | Knight Dermatology Institute | Forefront Dermatology | Partners Group | FL |

| December 2024 | Center for Dermatology | Epiphany Dermatology | Leonard Green Partners | MN |

| December 2024 | The Dermatology Center, PA | Epiphany Dermatology | Leonard Green Partners | MD |

| January 2025 | Town Square Dermatology | Epiphany Dermatology | Leonard Green Partners | IA |

| February 2025 | Four Seasons Dermatology | Integrated Dermatology | N/A | VT |

| February 2025 | West Valley Dermatology | Epiphany Dermatology | Leonard Green Partners | UT |

| March 2025 | Mark H. Lowitt, MD, LLC | Epiphany Dermatology | Leonard Green Partners | MD |

| March 2025* | Charlotte Dermatology | DOCS Dermatology Group | SkyKnight Capital | NC |

| March 2025 | Allan Mineroff, MD, PC | Dermatology Partners | N/A | PA |

| April 2025* | Skin Cancer Specialists | DermCare Management | Hildred Capital Management | TX |

| April 2025 | Team Dermatology | DermCare Management | Hildred Capital Management | TX |

| April 2025 | Clear Creek Dermatology | DermCare Management | Hildred Capital Management | TX |

| April 2025 | Sona MedSpa | DermCare Management | Hildred Capital Management | NC |

| April 2025 | Peak Dermatology | Epiphany Dermatology | Leonard Green Partners | CO |

| April 2025 | Pierre Skin Care Institute | Golden State Dermatology | Sorenson Capital | CA |

| June 2025 | Dermatology Centers of NEPA | The DermDox Group | Seven Isles Capital | PA |

| June 2025 | Dermatology Center of Loudoun | Integrated Dermatology | N/A | VA |

| June 2025 | Norris Dermatology and Laser Northwest | Epiphany Dermatology | Leonard Green Partners | OR |

| June 2025 | California Skin Institute | Schweiger Dermatology | LMK Partners | CA |

| July 2025* | SkinCare MT | Forefront Dermatology | Partners Group | MT |

| September 2025* | Wichita Dermatology | Forefront Dermatology | Partners Group | KS |

*PGP Served as Exclusive Sell-Side Advisor to Practice Owners (Target)

Physician Growth Partners (PGP) is a transaction advisory firm working exclusively with independent physician groups in transactions with private equity.

Differentiated Healthcare Transaction Advisors: