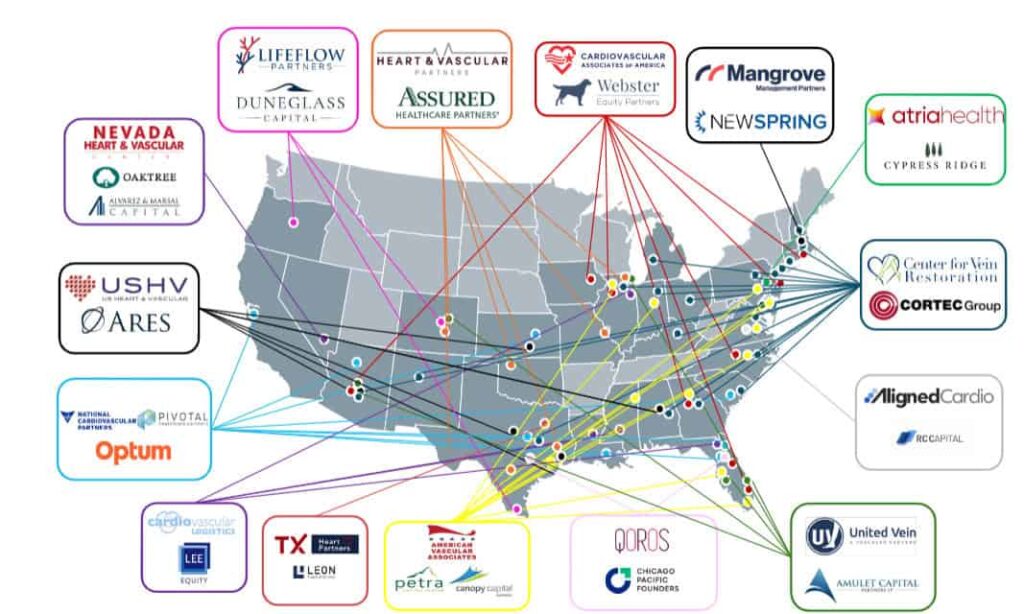

Cardiology is experiencing its own surge of private equity interest, with multiple physician practice management platforms, such as Cardiovascular Associates of America and StrideCare (Webster Equity Partners), US Heart and Vascular (Ares Management), and Cardiovascular Logistics (Lee Equity Partners), aggressively acquiring smaller groups and expanding market share. The cardiology sector is rapidly evolving into a competitive and consolidated landscape – mirroring trends seen earlier in other surgically driven specialties – while distinguishing itself through providing more control at the practice level to ensure patient care continues to be a top priority.

Source: Healthcare Dealflow

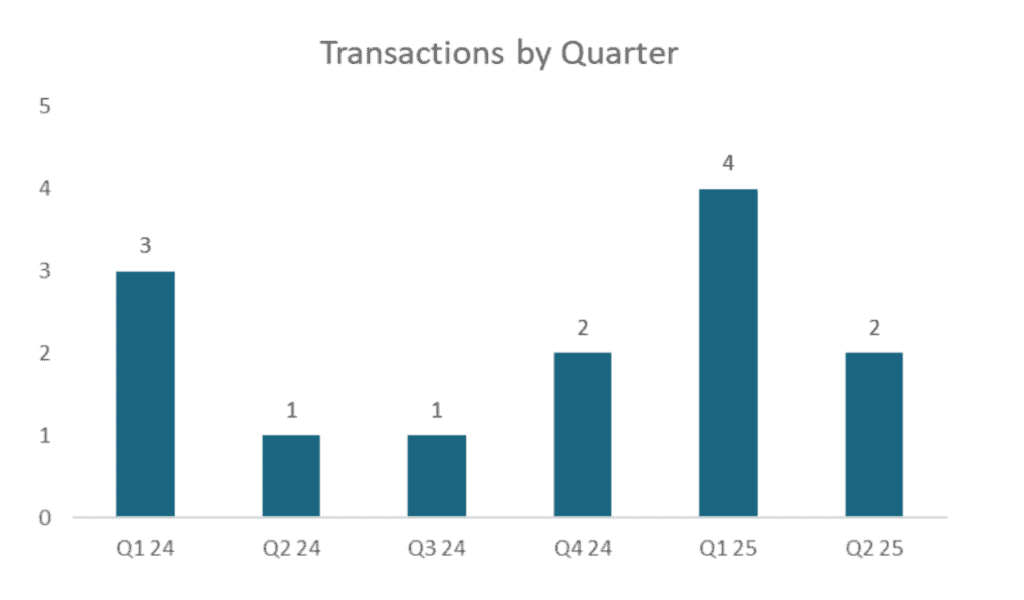

Following a significant wave of M&A activity between 2021 and 2023, the market has seen renewed momentum through the first half of 2025. The continued fragmentation of the cardiovascular sector is sustaining strong investor interest, and we expect cardiology to remain one of the most active areas within physician services M&A heading into 2026.

However, private equity backed cardiovascular buyers are increasingly targeting high-quality assets in select geographies, keeping competition and valuations elevated. Many private equity–backed cardiology groups are also approaching their “second bite” or recapitalization phase, injecting new capital to support ongoing acquisition strategies. At the same time, private equity firms continue to show strong interest in partnering with independent cardiology groups to establish new private equity backed cardiology platforms.

State-level regulations tied to the corporate practice of medicine continue to pose challenges for transactions, especially in California and Oregon. These hurdles are becoming more pronounced across additional states, as regulators continue to impose new limitations on healthcare investment.

It is essential that physician-owners seek appropriate guidance to navigate today’s complex dynamics.

| Date | Target | PE Sponsor | Platform | State |

| October 2025 | Vascular Health | Amulet Capital Partners | United Vein & Vascular Centers | NJ |

| August 2025 | Vascular Institute of the Rockies | Assured Healthcare Partners | Heart & Vascular Partners | CO |

| July 2025 | Coastal Vascular & Vein Center | Webster Equity Partners | StrideCare | SC |

| June 2025 | Fort Worth Heart Partners | Ares Management | US Heart & Vascular | TX |

| April 2025 | Cardiology Consultants of Philadelphia | Lee Equity Partners | Cardiovascular Logistics | PA |

| Nov 2024 | Surgical Associates Chartered | Petra Capital / Canopy Capital | American Vascular Associates | MD |

| Oct 2024 | Birmingham Heart Clinic | Ares Management | US Heart & Vascular | AL |

| July 2024* | Florida Heart & Rhythm Specialists | Webster Equity Partners | Cardiovascular Associates of America | FL |

| July 2024* | Kenneth H. Zelnick, MD | Webster Equity Partners | Cardiovascular Associates of America | FL |

*PGP Served as Exclusive Sell-Side Advisor to Practice Owners (Target)

Physician Growth Partners (PGP) Physician Growth Partners (PGP) is an advisory firm working exclusively with independent physician groups in transactions with private equity.

PGP has completed 15+ transactions in the last 12 months. Our firm is differentiated by: